Many workers who apply for Social Security disability benefits also qualify for workers’ compensation benefits as a result of a work-related injury. If you receive SSD at the same time that you receive monthly payments from workers’ compensation, you may find that the payment you get from the state reduces what you receive from Social Security disability.

State workers’ compensation programs offer workers an option to give up the monthly payment they are entitled to receive in return for a lump-sum settlement of their compensation case. Taking a lump settlement may be a good option that you should discuss with your workers’ compensation lawyer, but you also need guidance and advice from an SSD lawyer at Liner Legal Disability Lawyers about strategies that could lessen the impact of the payment on your monthly Social Security Disability Insurance benefits.

What Happens To SSDI When You Also Receive Workers’ Comp Benefits?

Workers’ compensation and other public benefits that you receive must be reported to the Social Security Administration when you apply for or receive SSDI benefits. The reason is that the combined total of the workers’ comp and state disability benefits along with your monthly SSDI cannot exceed 80% of the average current earnings you had when you became disabled and were no longer able to work.

What this means in terms of your monthly SSDI payment is best demonstrated by an example provided by Social Security of a worker with average monthly earnings of $4,000 who becomes disabled and can no longer work. The disabled worker, the worker’s spouse and their two children qualify for SSDI benefits of $2,200 each month.

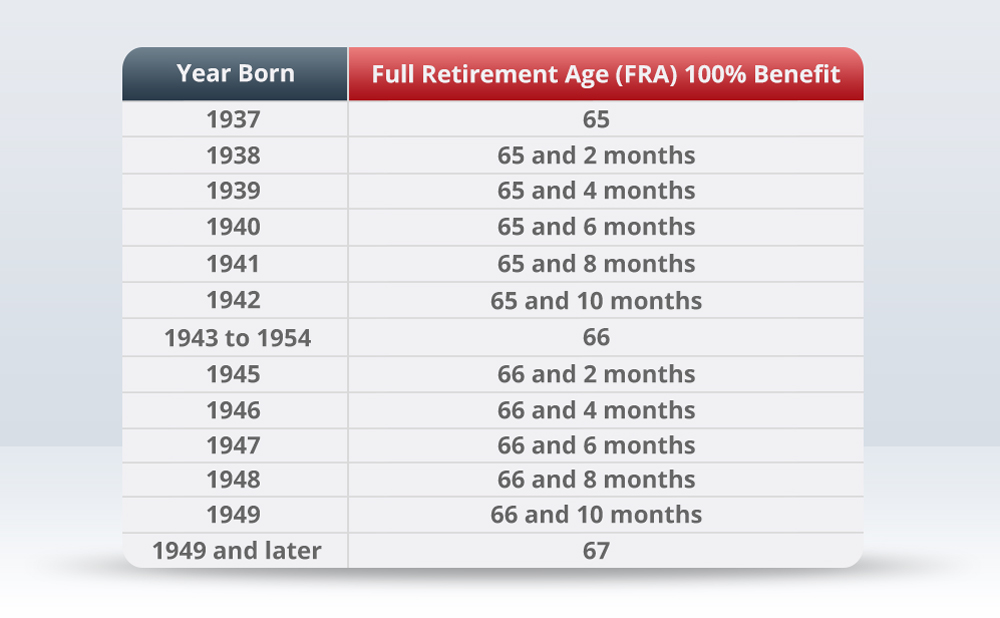

However, the worker also receives $2,000 a month through workers’ compensation, which makes the total state and federal benefits $4,200 or $1,000 more than 80% of the person’s average current earnings when employed. The family continues to receive their workers’ compensation monthly payment, but the SSDI benefit is reduced by $1,000 until the compensation benefits end or the worker reaches full retirement age when SSDI converts to retirement benefits.

If you receive monthly payments from a workers’ compensation program or other public benefit programs, discuss it with one of the SSDI lawyers at Liner Legal. Some types of public benefit payments do not affect your disability benefits. Benefits received through the Veterans Administration, for example, do not reduce what you are entitled to get through SSDI.

Lump-sum settlements and Social Security disability

Things get a bit more complicated when a worker elects to accept a settlement in lieu of continuing to receive monthly payments from workers’ compensation. If you receive a lump-sum payment in settlement of your workers’ compensation case, Social Security divides the amount of the settlement by your monthly SSD benefits. For example, if you get a lump-sum payment of $20,000 and divide it by the $2,000 monthly SSDI benefit, the result is 10. Social Security suspends your SSDI payments for 10 months.

The lump-sum payment from workers’ compensation will offset your SSDI benefit, but there are ways to minimize its impact, including:

- If the settlement includes legal fees, rehabilitation costs, and past or future medical expenses, Social Security excludes them from the lump-sum payment to reduce how it affects your monthly SSDI payment.

- A lump-sum settlement may include language amortizing or spreading out the payment over the life of the claimant as determined from actuarial tables. The net effect is that the lump-sum payment is treated as though it is collected over the number of months equal to the life expectancy of the individual or the individual’s expected work life. The monthly amount is used to determine whether a workers’ compensation offset applies.

Always remember that once your SSDI benefits convert to retirement benefits at full retirement age, you may receive them along with workers’ compensation without regard to an offset. If you are eligible to take early Social Security retirement benefits at 62 years of age, discuss the advantages and disadvantages with a disability lawyer. An advantage could be that taking retirement benefits eliminates the workers’ compensation offset issue, but your lawyer can discuss whether it would be the best option for you.

Learn more from an SSDI and SSI lawyer

The Supplemental Security Income program also pays benefits to people with disabilities, but it has a limit on the amount of income and resources that you can have available to you and still qualify for benefits. As a result, workers’ compensation benefits, either monthly or as a lump-sum settlement payment may affect your SSI benefits. An SSI lawyer at Liner Legal Disability Lawyers has answers to questions you have about SSI, SSDI, and how each works with other disability benefit programs. Learn more by scheduling a free consultation with an SSD benefits lawyer at Liner Legal today.