You may have either heard or read about Social Security disability converting to retirement benefits when you reach retirement age. If you receive benefits through the Social Security Disability Insurance program, you may wonder at what age the disability benefits convert and whether it will result in a reduction in your monthly benefit payment.

If you receive SSD benefits through the Supplemental Security Income program, your concerns may be even greater. You may not have a work history either at jobs or through self-employment that would allow you to qualify for Social Security retirement benefits, so you probably have concerns about how the conversion of disability affects you.

Fortunately, answers to the questions you have about Social Security disability benefits convert to retirement benefits are available at Liner Legal Disability Lawyers when you speak with an SSD lawyer. To help you to better understand how the conversion of benefits may or may not affect you, the following information should give you a better understanding of what actually happens when disability payments convert to retirement benefits.

SSI benefits are not affected by reaching retirement age

If the only benefits that you receive each month are through SSI, you need not be concerned about them converting to retirement benefits. Funding for the SSI program does not come from Social Security taxes on income earned from jobs or through self-employment as does the funding for SSDI.

Your SSI payments continue for as long as you remain disabled and meet the limits on income and resources to remain eligible for the program. The fact that you reach what would be the age for full retirement under Social Security does not affect your SSI payments.

If you have a work history and qualify for SSDI benefits in addition to SSI, you may see a reduction in your SSI payment each month when the SSDI benefits convert to retirement. The reason is that Social Security retirement payments count as income each month and reduce what you can receive from SSI. Should be receiving SSDI and SSI, speak with an SSI lawyer at Liner Legal to learn more about what effect conversion of the SSDI will have on your SSI.

Why do SSDI payments convert to retirement benefits?

When you work and pay into the Social Security system through the payroll taxes on your earnings at work or through payment of taxes on income earned through self-employment, you become eligible for retirement benefits when you reach retirement age. Being “insured” also makes you eligible for SSDI in the event that you become disabled and unable to work before reaching retirement age.

A medically determinable physical or mental impairment expected to last for at least one year or cause your death may allow you to qualify for SSDI provided the impairment or impairments prevent you from engaging in substantial gainful activity. Suppose you meet this definition for disability and qualify for monthly SSDI benefits. In that case, the amount you receive is equivalent to your Social Security retirement benefit based on your earnings record.

Will my payments change when SSDI converts to retirement?

As a general rule, do not expect to see a change in the payment you receive each month after your SSD benefits convert to retirement. In fact, you may actually see it increase if you also receive other types of disability benefits, such as workers’ compensation.

Payments from workers’ compensation and public disability benefits you receive from working at a government job with earnings that were not subject to payment of Social Security taxes may reduce monthly SSDI benefits. However, these other payments do not count against retirement benefits, so any deductions made to your SSDI payments because of them come to an end when they convert to retirement.

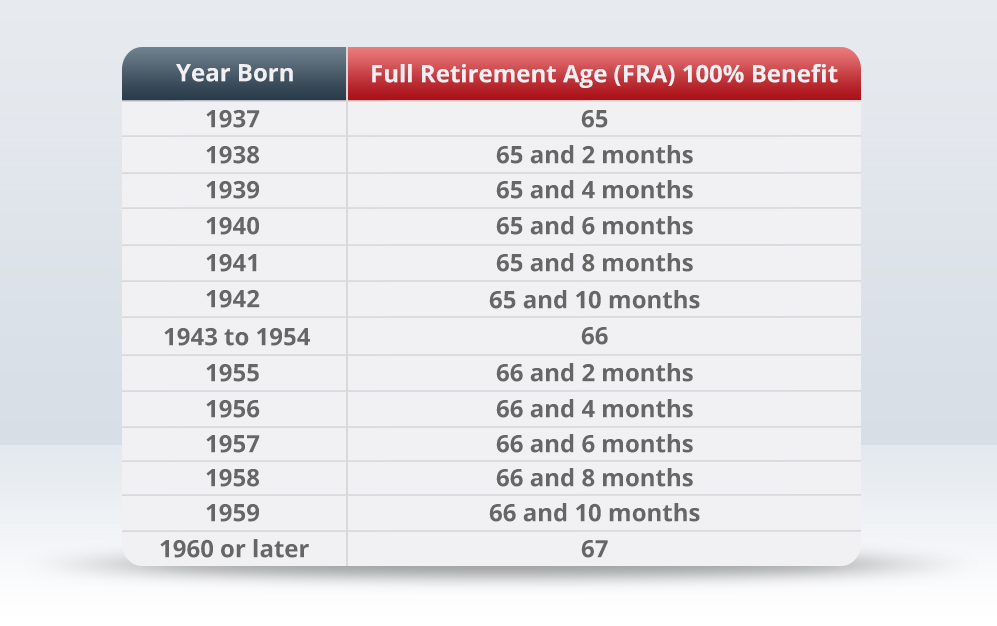

Full retirement age is not the same for everyone

Full retirement age is based on the year of your birth. If you were born in 1960 or later, you reach full retirement age when you are 67 years old. However, someone born between 1943 and 1954 reached full retirement age when they were 66 years old.

Although you may be eligible to begin receiving retirement benefits from Social Security at 62 years of age, the monthly benefit payment is lower than what it would be by waiting until full retirement age. When you eventually reach full retirement, the monthly payments continue at the reduced rate because you took early retirement.

A chart provided by the Social Security Administration lets you check your full retirement age and determine the difference in monthly benefits by taking early retirement. If you receive or are applying for SSD benefits, speak with an SSDI lawyer at Liner Legal before filing for early retirement because doing so may affect your SSD payments.

Learn more about SSDI and SSI

A free consultation with an SSD lawyer at Liner Legal Disability Lawyers gets you all of the advice, guidance and experienced representation you need for all matters related to SSDI and SSI. From filing applications for benefits to handling appeals of benefit denials, Liner Legal helps you to obtain the benefits you deserve.