Filing an application for Social Security disability can best be described as a frustrating ordeal. The majority of initial applications result in a denial of benefits that must be challenged through a lengthy appeal process.

If you finally succeed in obtaining approval of your claim for SSD benefits, it’s hard to keep from wondering whether you can rely upon this much-needed financial assistance to continue and for how long. An SSD lawyer at Liner Legal Disability Lawyers understands your frustration and concerns. Please take a moment to read through the following information to get a better understanding of what affects a continuation of disability benefits, and feel free to contact us about any questions or concerns that you have about your benefits.

Meeting financial guidelines for the SSI program

When a medically determinable mental or physical impairment causes you to be disabled and unable to work, you may be eligible for benefits through the Supplemental Security Income or Social Security Disability Insurance programs. Eligibility requirements for each program may affect a continuation of benefits after you are initially approved.

To qualify for SSI, you must be disabled or blind with limited income and resources. Improvement of your medical condition or an increase in your income or the value of resources may result in a reduction or termination of benefits.

Resources may not exceed a total of $2,000 for an individual or $3,000 for married couples with both spouses eligible for SSI benefits. However, some resources are treated differently than others. For instance, the value of a home that you own and rent to tenants would count as a resource; however, if you occupy it as your principal residence, it does not count as a resource.

Resource and income limits have exclusions that you should discuss with an SSI lawyer to determine whether they apply to your particular situation. It is a good idea to get advice before selling an asset to determine what effect the sale will have on your continued eligibility for SSI. For example, the principal residence that is an excluded resource may threaten your continued eligibility for benefits when you decide to sell it.

Federal regulations do not count the proceeds from the sale of your principal residence provided you use them to buy a new home that you occupy as a new principal residence. You only have three months to acquire a new home. Any money not reinvested in a new principal residence within three months counts toward the $2,000 or $3,000 resource limits.

Retirement age and SSDI benefits

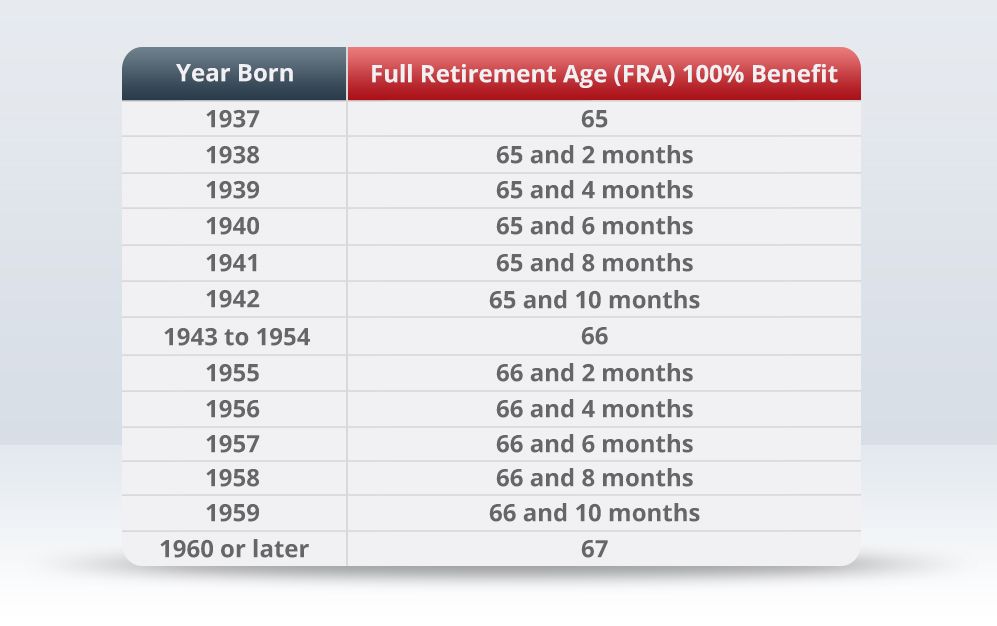

If you qualify for SSDI benefits, they continue for as long as you remain disabled. However, SSDI payments end and Social Security retirement benefits begin when you reach the age at which you are eligible for full retirement. Full retirement age is determined based on the year you were born. For example, if you were born after 1960, you are eligible for retirement benefits when you reach 67 years of age.

You do not have to do anything upon reaching the age for full retirement. Social Security automatically converts your SSDI payments to retirement benefits. Generally, you will not see any change in the amount of your monthly benefit. In fact, your retirement payment may be more than you received while collecting SSDI.

This may happen when you also collect workers’ compensation benefits along with SSDI. The workers’ compensation payment may reduce how much SSDI pays you each month. When you reach full retirement age and the SSDI converts to retirement benefits, the workers’ compensation reduction no longer applies.

The conversion of SSD payments to retirement benefits only applies to SSDI. It does not apply to benefits received through SSI.

Improvement in your medical condition

Unless you qualify for SSI because you are 65 years of age or older with limited income and resources, you must be disabled or blind to be eligible for SSD. Social Security uses the same definition of disability for SSDI and adults applying for SSI that requires the following:

- A medically determinable physical or mental impairment.

- The impairment or impairments must prevent you from engaging in substantial gainful activity.

- The impairment or impairments must have lasted or been expected to last for at least one year or result in your death.

A different disability definition applies to applications for SSI submitted on behalf of children.

If your medical condition improves to the point that you no longer meet the definition, Social Security may determine that you no longer qualify for SSD benefits. Social Security performs medical continuing disability reviews of your claim every three years, but if your medical condition is one that is not expected to improve, a review is conducted every five to seven years.

Get advice from an SSD lawyer

You have the right to challenge a determination by SSDI and SSI that affects your right to continue receiving benefits, but you need a skilled and experienced SSD lawyer who knows the laws and regulations. Learn more by contacting Liner Legal Disability Lawyers for a free consultation and review of your claim.