The amount of Social Security benefits each recipient receives differs. The benefit payment is determined by the data generated by each Social Security applicant during their working years. In this blog post, we’ll explain precisely how the payment amounts of your monthly Social Security Disability benefits and your Social Security Retirement benefits are calculated.

The terms used by the Social Security Administration sound unfamiliar, and the alphabet soup of acronyms can be confusing, but we’ll show you how the government calculates your benefit payment amount.

At Liner Legal Disability Law, our team of Social Security Disability (SSD or SSDI) and Supplemental Security Income (SSI) lawyers specialize in every aspect of disability law and will help you get the maximum benefits possible. We focus our entire legal practice exclusively on disability law. If you are in the Cleveland area or anywhere near one of our seven other locations, contact us to learn all the answers to your questions about disability law and Social Security Disability benefits.

What Figures Determine the Amount of Your Social Security Disability Benefits?

The Social Security Administration (SSA) uses the same figures to establish the amount of your Social Security Retirement (SSR) benefits as it uses to set the amount of your Social Security Disability benefits. The same figures are entered into the same formula and the resulting benefit payment amount is identical in both programs.

Both SSD and SSR benefits are based on the amount of taxable income you reported to the IRS throughout your working life. You paid Social Security taxes on every payroll check and all your self-employment income.

The SSA finds your 35 highest income-earning years and indexes them against each year’s national average to adjust the income figures for the cost of living increases over the years. Then it adds the 35 indexed income figures together and divides them by 35 and again by 12 to produce what is called your Average Indexed Monthly Income (AIME). It is this number, the average monthly income you earned over the years, that serves as the base for the benefit-determining formula.

Your AIME Gives the Social Security Administration Your Primary Insurance Amount (PIA)

Your Average Indexed Monthly Income (AIME) was obtained by averaging together all your annual earnings for your 35 best earning years. Then the AIME is plugged into the following formula that sets your benefit payments for both SSDI and Social Security Retirement.

Here’s how it works. To find the amount of SSD or SSR benefits you receive, ADD the following numbers:

- 90% of the first $1,024 of your AIME, plus

- 32% of the AIME over $1,024 up to $6,172, plus

- 15% of any AIME over $6,172

- then round down to the nearest whole dollar.

The result of this formula is the amount of your SSDI and your SSR benefits.

Let’s run through an example — Assume our test worker named Bob earned an average indexed monthly income (AIME) of $5,678.90. We’ll put that figure through the formula to see what Bob’s SSDI benefit payments and his Social Security Retirement benefit payment will be:

- 90% of the first $1,024 of Bob’s $5,678.90 AIME = $921.60, plus

- 32% of Bob’s AIME over $1,024 up to $6,172 = $1,647.30, plus

- ($6,172 – $1,024 = $5,148) then ($5,148 x 32% = $1,647.30)

- 15% of any of Bob’s AIME over $6,172 = 0.00

$912.60 + $1,647.30 + 0 = $2,559.90 then round down to nearest dollar = $2559.00

The figure resulting from the formula (before rounding down to the nearest dollar) is called Bob’s Primary Insurance Amount (PIA). Once rounded down, this is Bob’s SSD benefit amount and also his Social Security Retirement (SSR) benefit amount.

Early Retirement at Age 62 +

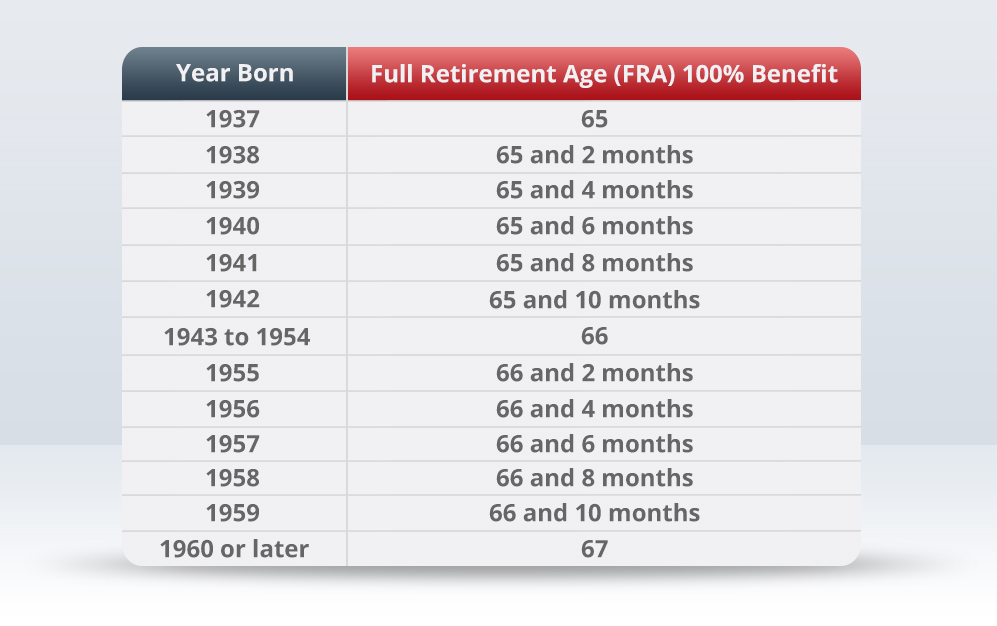

The Social Security Retirement (SSR) benefit determination procedure produces the payment you receive at your Full Retirement Age (FRA). For SSD recipients who begin receiving benefits before their scheduled FRA, the income figures used are those generated up to their last date of work.

People who file for Social Security Retirement benefits early, at age 62 or later but before they reach their full retirement age, will receive only 70% of their full retirement age benefit. They permanently waive any claim to receive 100% of their FRA benefits.

When someone claims retirement benefits from Social Security Retirement at age 62 and later learns they have a qualified disability, they can file for SSDI benefits and receive a disability benefit equal to 100% of their FRA benefits. However, when that person reaches their full retirement age, the payment of their monthly benefits will revert to the earlier 70% level.

Liner Legal Disability Lawyers Will Fight for Your Maximum SSD Benefits

If you live anywhere in Ohio, Liner Legal has an office near you. We analyze every aspect of your case to obtain a positive disability determination from the Social Security Administration. We also ensure that you receive the full retroactive benefit payments you deserve by arguing for the earliest disability onset date the evidence supports.