Dealing with the demise of a loved one can be mentally and emotionally tormenting. However, it is important that you have a grip on your prospects and a rough idea about your benefits. Therefore, Social Security widow benefits may be a savior for someone passing through such a horrendous situation. Whether you receive Social Security widow benefits, and their quantum depends on a multiplicity of factors like the widow’s age, the deceased spouse’s age, and if the deceased spouse had benefits of their own at the time of his death.

There are ways to maximize the amount you are entitled to receive, but you must understand the complicated Social Security Disability (SSD) rules and process. Many a time, claimants tend to make hurried decisions that do not allow them to qualify for Social Security widow benefits or do not allow them to earn the maximum possible benefits amount.

Eligibility For Social Security Widow Benefits

If you are passing through testing times when you have lost a spouse, you must be able to determine whether you qualify for Social Security widow benefits.

To be eligible to get your deceased husband’s Social Security, you must have been married to him for at least nine months before your spouse passed away. Also, your spouse must have worked long enough for Social Security to grant your deceased spouse retirement benefits. You can, however, start receiving benefits only if you are at least 60 years old.

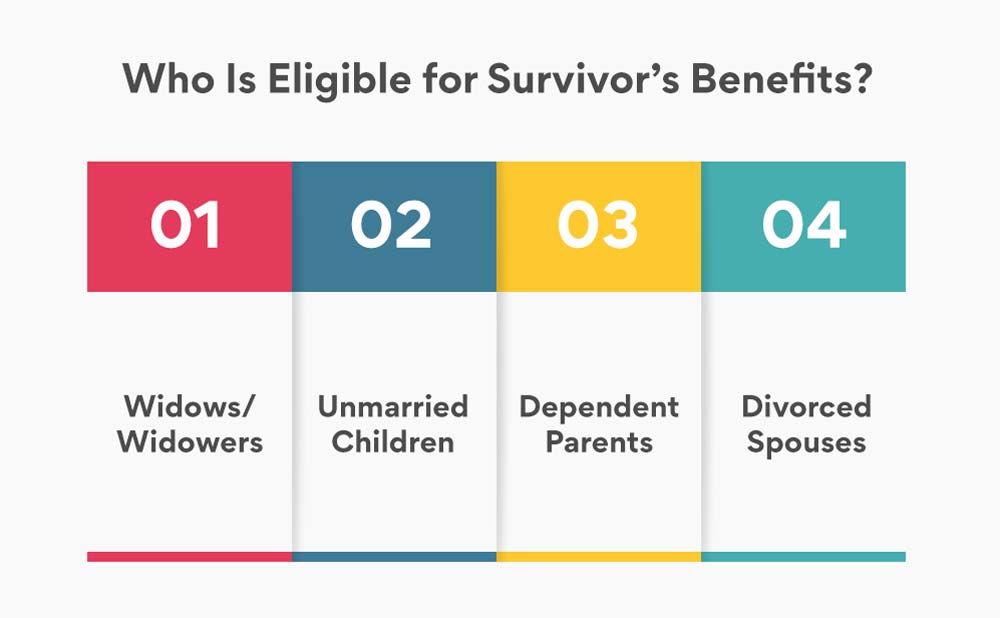

Who Is Eligible for Survivor’s Benefits?

Apart from a surviving widow, there are several other categories who are eligible to receive survivor’s benefits-

Widows/ Widowers

- widow/ widower can receive 100 percent of the benefits if they have reached the full retirement age. For survivors born between 1945 and 1956, this age is 66 and will slowly rise to 67 over the next several years.

- You can start receiving benefits if you are aged 60. If you are disabled, you can start receiving benefits at age 50 but the benefits will be reduced till you reach the full retirement age.

- When receiving benefits before retirement age, you can get anywhere between 71 and 99 percent of benefits.

- If the survivor is caring for a child aged below 16, they can get 75 percent of the benefits.

Unmarried Children

- Children aged under 18 can also receive benefits. However, even if they are over the age of 18 years, they can receive benefits if they are still attending high school as a full-time student. The child will get 75 percent of the benefits.

- In certain circumstances, some stepchildren, adopted children, or even grandchildren can also get benefits. If the child got disabled before age 22 and are still disabled, they will get benefits at any age.

Dependent Parents

- Dependent parents aged at least 62 can also receive benefits. A dependent parent qualifies for benefits if the parents were dependent on the deceased for at least 50 percent of their support.

Divorced Spouses

- If your divorced spouse passes away and you were married for at least 10 ten years and you are aged at least 60. However, this rule may vary depending on your situation and your marital status, that is, whether you have remarried.

Can I Collect My Deceased Spouse’s Benefits Along With My Social Security

Social Security will not combine your deceased spouse’s benefits and your own and pay you both. There may be a situation where you are eligible for both benefits but in such a case, you can get only one of those benefits. Social Security does not add survivor’s benefits and retirement payments, it pays you the greater of these two benefits.

If the retirement benefit is the higher amount, retirement payment is all that you will get. However, if the survivor’s benefits are higher, Social Security will pay the retirement benefit first and top it up with the deficient amount of the survivor’s benefit.

Whether the survivor’s benefit exceeds your own Social Security payment will depend on your late spouse’s benefit and your own age and family education.

If you are already receiving spousal benefits at the time of the passing away of your husband, Social Security will automatically convert those benefits to survivor’s benefits. However, you must report the factum of the death of your husband to Social Security.

Contact Liner Legal To Win The Survivor’s Benefits You Deserve

At Liner Legal, we have a team of committed disability lawyers who want to help you win the benefits you need and deserve. We understand that losing a loved one can be difficult, but you must have a clear vision of your future. Contact us today for a free consultation to know if you are entitled to win survivor’s benefits and how you should go about it.