An estimated 182 million workers contributed to Social Security through payroll and self-employment taxes in 2022. But how much do you know about the benefits you can expect to receive from Social Security when you reach your full retirement age, or you become disabled during your working years?

Few people really understand how Social Security works, how your benefit amount is determined, and how much some of your family members can expect to receive if you pass away. This blog explains these issues and tells you which family members can claim survivor benefits based on your work record following your death. If you have questions about survivor benefits or any Social Security program, is ready to give you all the information you need. Liner Legal is exclusively dedicated to getting Social Security and other benefits for people like you.

Who Is Entitled to Receive Death Benefits from Social Security?

Social Security benefits are funded by contributions from workers’ payroll deductions and self-employment taxes. The purpose of the program is to ensure that there is money available to provide financial support for older workers when they reach full retirement age (FRA). The program also supports eligible workers who suffer qualifying disabilities before they reach retirement.

But what happens if a worker who has paid into the system for their entire working life but dies either before or after they start receiving their retirement benefits? The Social Security program ensures that certain survivors can collect the benefits that would have been paid to the deceased worker.

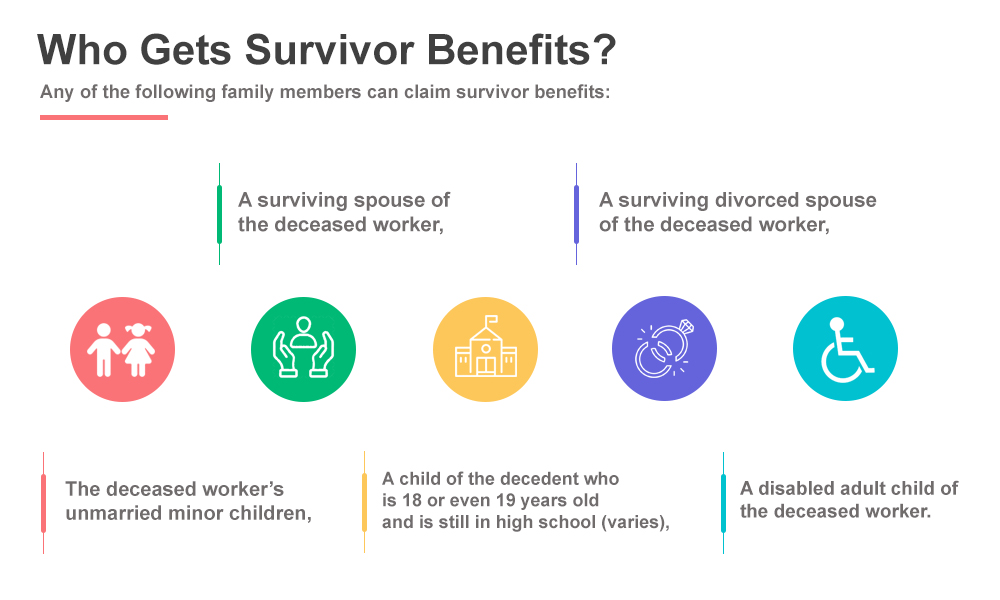

Who Gets Survivor Benefits?

Any of the following family members can claim survivor benefits:

- A surviving spouse of the deceased worker,

- A surviving divorced spouse of the deceased worker,

- The deceased worker’s unmarried minor children,

- A child of the decedent who is 18 or even 19 years old and is still in high school (varies),

- A disabled adult child of the deceased worker.

How Much Do Survivors Receive in Social Security Death Benefits?

The amount a survivor of a deceased worker receives depends on the circumstance of the individuals involved. Some key factors include the age of the decedent at the time of their death, the age of the survivor claiming the death benefit, whether one or more family members are juveniles, and whether there are any disabled family members who can claim a death benefit.

In addition to the benefits detailed below, the Social Security Administration pays a one-time death benefit of $255 to a surviving spouse or, if no spouse survives, to the next eligible child.

These family members can expect to receive the following amounts as death benefits:

- Surviving spouse who is Full Retirement Age or older receives 100 % of the decedent’s benefit

- Surviving former spouse (if a 10-year marriage) at FRA receives 100 % of the decedent’s benefit

- Surviving spouse aged 60 thru FRA receives between 71 ½ % to 99 % of the decedent’s benefit

- Disabled surviving spouse aged 50 thru 59 receives 71 ½ % of the decedent’s benefit

- Surviving spouse at any age caring for a child under 16 years old receives 75 % of the decedent’s benefits

- The decedent’s child under age 18 (or 19 if in secondary school), or child with a disability receives 75 % of the decedent’s benefits

- One surviving dependent parent of the deceased worker receives 82 ½ % of the decedent’s benefit

- Two surviving dependent parents of the deceased worker each receive 75 % of the defendant’s benefit.

More Important Details:

There are significant exceptions to the general rules outlined in the previous list of benefits survivors may expect to receive based on the decedent’s work history.

- Remarried Former Spouse: A surviving former spouse of the decedent who was married to them for at least ten years is eligible for the full surviving spouse benefit unless they remarry before they reach age 60. A former spouse who remarries after age 60 is eligible for the full surviving spouse benefit. However, if their current spouse receives Social Security benefits, their work record may provide a higher benefit than your former spouse’s account. If you claim the benefits through your higher-earning current spouse, you would receive a combination of payments equal to the higher amount you are entitled to.

- Two-Year Limit to File a Death Benefit Claim: Any person eligible to receive Social Security benefits through the work record of a deceased person must file their survivor benefits claim within two years of the deceased worker’s death.

Get Detailed Help with Your Social Security Survivor Benefits Claim

The rules governing who can claim Social Security survivor benefits or death benefits following the death of a loved one can be complicated. If you have questions about your eligibility to claim survivor benefits, get the answers you need today.

Don’t wait to learn about your rights to Social Security benefits through your deceased spouse, parent, or child. Let Liner Legal provide you with the details and assist you with preparing and filing your claim.