The Supplemental Security Income program has financial restrictions that applicants must meet in order to qualify for benefits. When an application for benefits is submitted on behalf of a child, the income and resources of the parents must be reported and considered as part of the process to determine the eligibility of the child to get SSI benefits.

The process that takes into consideration the assets and income of a parent and, in some instances, the income of a stepparent is known as “deeming.” Liner Legal Disability Lawyers wants you to know how deeming works. As you read through this article, keep in mind that deeming is complicated and does not count all assets and resources. An SSI lawyer at Liner Legal is available to help you with applications and appeals.

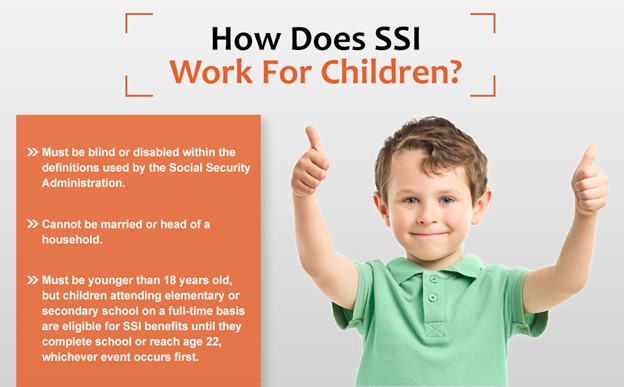

How does SSI work for children?

The SSI program provides a monthly federal benefit of $841 for an individual and $1,261 for eligible couples in 2022. Some states supplement the federal benefit, so what someone receives each month may be more than the federal benefit.

In order to qualify for SSI benefits, a child must meet the following program requirements:

- Must be blind or disabled within the definitions used by the Social Security Administration.

- Cannot be married or head of a household.

- Must be younger than 18 years old, but children attending elementary or secondary school on a full-time basis are eligible for SSI benefits until they complete school or reach age 22, whichever event occurs first.

Children and adults applying for SSI must meet the same definition when applying because of blindness. However, disabled children have their own definition of disability that differs from the one that applies to adults.

An application for SSI filed on behalf of a disabled child must be supported by medical records demonstrating that the disability is caused by a medically determinable physical or mental impairment that has lasted or is expected to last for at least 12 months or result in death. The impairment or a combination of impairments must cause marked and severe functional limitations.

Children who qualify for SSI have their claims reviewed when they reach age 18 to determine whether they meet the disability definition that applies to adults. A disabled adult is someone with a medically determinable physical or mental impairment that has lasted or is expected to last for at least 12 months or cause death. The impairment or impairments must affect the ability of a person to engage in substantial gainful activity.

How much can a parent make for a child to qualify for SSI?

A child applying for SSI benefits must meet the financial guidelines for the program. Earned income, which includes money an applicant receives as compensation for work they perform, cannot exceed $1,767 a month for a single person and $2,607 for eligible couples in 2022. Unearned income, which includes dividends and interest, cannot exceed $861 for a person or $1,281 for couples.

Resource limits also apply, so a person cannot have resources exceeding a total value of $2,000 for one person and $3,000 for eligible couples. Resources generally refer to assets a person can use to acquire food and shelter.

When the applicant for SSI is a child, deeming applies. Deeming lets Social Security take into account parental income when determining whether a child meets the income and resource criteria for SSI. It is important to note that not all parental income is deemed available to support a child applying for SSI.

The child must be living with a parent for deeming to apply. In situations where a child lives with a parent and a stepparent, the stepparent’s income and resources are considered in evaluating the eligibility of the child for SSI benefits. How much can a parent make for a child to get SSI is not as straightforward as simply looking at the parent’s paystub?

Exclusions apply to parental earned income before you arrive at the amount deemed available for support of the child. For example, if there are nondisabled children living in the household, $420 of monthly parental income is allocated to that child. Another $85 parental income may be excluded under federal regulations.

Of the balance of monthly income that remains, a parent may exclude an amount equal to the federal SSI benefit, which is $841 in 2022 for living expenses. Whatever portion of a parent’s earned income remains is deemed available to the child and considered in determining if the child meets the financial criteria to qualify for SSI.

Contact Liner Legal Disability Lawyers to learn more

An SSI lawyer at Liner Legal Disability Lawyers can offer additional information about the effect of deeming on your child’s application for SSI benefits. Contact us today to schedule a free consultation and claim review.